challengingzone.ru Community

Community

May Checking Account Bonus

This is the Weekly Bank Account Bonus Thread. Use it for anything related to bank accounts and bonuses, such as: Churning mechanisms (DD, etc). Are there any catches to these kinds of offers? You may have to check off a few tasks to receive the full checking account bonus or other offer. It's possible. Get $ with our checking account bonus offer. Earn $ when opening an eligible Fifth Third checking account with qualifying activities. Grow your relationship with Legacy Bank and receive a $ bonus when you open a new personal or business checking account. This offer is limited to first time deposit customers who open a new Select NOW checking account. May receive a $ bonus with required minimum opening deposit. 1. Open your first Flex Checking or Flex Checking Plus between May 1 and December 31, ; 2. Set up direct deposit to your new checking account ; 3. Make sure. Open your checking account · Set up Direct Deposits · Earn up to a $ cash bonus · Explore checking account options. Open an account by September 30, and have a total of at least $ in qualifying direct deposits within 90 days of account opening to qualify to receive an. Member FDIC. Enjoy a $ bonus when you open a new Everyday checking account with qualifying electronic deposits. This is the Weekly Bank Account Bonus Thread. Use it for anything related to bank accounts and bonuses, such as: Churning mechanisms (DD, etc). Are there any catches to these kinds of offers? You may have to check off a few tasks to receive the full checking account bonus or other offer. It's possible. Get $ with our checking account bonus offer. Earn $ when opening an eligible Fifth Third checking account with qualifying activities. Grow your relationship with Legacy Bank and receive a $ bonus when you open a new personal or business checking account. This offer is limited to first time deposit customers who open a new Select NOW checking account. May receive a $ bonus with required minimum opening deposit. 1. Open your first Flex Checking or Flex Checking Plus between May 1 and December 31, ; 2. Set up direct deposit to your new checking account ; 3. Make sure. Open your checking account · Set up Direct Deposits · Earn up to a $ cash bonus · Explore checking account options. Open an account by September 30, and have a total of at least $ in qualifying direct deposits within 90 days of account opening to qualify to receive an. Member FDIC. Enjoy a $ bonus when you open a new Everyday checking account with qualifying electronic deposits.

Citibank: Earn a cash bonus of $ when you open an eligible checking account by Oct. 8, Deposit two enhanced direct deposits totaling at least $1, These bonuses allow you to earn the most with the least amount of work. Most are nationally available, but a few may only be available in certain states. Offer is not available to those whose accounts have been closed within the last 2 years. You may only receive one new account opening-related bonus every two. Value of promo: $20; earn up to 5% cash back at Neo partner stores. Offer validity: Ongoing. Caveats: Online banking and the account may not fully replace your. Earn up to $ checking account bonus simply by applying online. Choose the checking account right for you and apply today. Fees may reduce earnings. Personal Accounts only. Offers available only to residents of MA, NH, and RI. Offers subject to change at any time. *$ Bonus offer. This bank may offer other promotions right now as well; see more Chase Bank Bonuses. The bonus is only available to customers who haven't received a new Chase. If you are a Citizens Personal Checking, Savings or Money Market account customer that has set up a direct deposit with a payor, you may be able to get that. To receive the bonus: 1) Open a new qualifying checking account, which is Checking accounts may be opened with a $25 deposit. After the full day. Apply for a checking account online today and earn $ with Associated Bank's current checking account bonus offer Carrier message and data rates may apply. Plus, earn a $ bonus through 5/31/23! No Monthly Fees. Wings First Class and High-Yield Checking accounts have no monthly maintenance fees. Qualifying Checking Accounts [1] $ New Account Cash Bonus. In order to be eligible to obtain the cash bonuses, you must open one of these new accounts. To qualify for the $ cash bonus you are required to open a new Priority Platinum Checking account and have qualifying direct deposit(s) totaling $ per. Earn up to $ 1 when you open a new Affinity Checking account. Get all the essentials for everyday banking, along with benefits that can help you on your. Earn up to a $ bonus when you open a new, eligible US Bank business checking account online with promo code Q3AFL24 and complete qualifying activities. A fee will apply for cash withdrawals at ATMs not operated by Newtown Savings Bank. This fee is separate from any fee the ATM operator may charge you. A paper. Plus Plan Chequing Account: If you're looking for a basic account, you might want to consider the Plus Plan Chequing Account, which offers a bonus of $ Member FDIC. New customers can open a Clear Access Banking account online with qualifying requirements for a $ bonus offer. Offer also available in. Get up to $* with Old Second! Use promo code EM2 when you open your new checking account online or visit a branch and mention this ad.

Cost Per 1000 Car Loan

Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. Auto Loan ; & Newer Vehicle Rates · 1 · % · $ per $1, · % ; Vehicle Rates · 2 · % · $ per $1, · % ; & Older Vehicle. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. Use this calculator to help you determine your monthly car loan payment or your car purchase price. Car payment is $ per month. *indicates. Monthly payment of $ per $1, financed. Offer may vary by location. Other rates and payment terms available. Cannot be combined with any other coupon. Your interest rate is a percentage of the total loan, tacked onto your monthly payment. If you don't know what interest rate you're approved for, you can use. Our calculators can help you determine vehicle purchase price, down payment amount, loan term, and more that best suit your budgeting needs. Purchase Price: It is recommended that the monthly auto loan payment alone is limited to about 10% to 15% of your after-tax take-home pay. A lower purchase. With our car payment calculator, you can quickly determine how much you'll owe the loan company each month. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. Auto Loan ; & Newer Vehicle Rates · 1 · % · $ per $1, · % ; Vehicle Rates · 2 · % · $ per $1, · % ; & Older Vehicle. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. Use this calculator to help you determine your monthly car loan payment or your car purchase price. Car payment is $ per month. *indicates. Monthly payment of $ per $1, financed. Offer may vary by location. Other rates and payment terms available. Cannot be combined with any other coupon. Your interest rate is a percentage of the total loan, tacked onto your monthly payment. If you don't know what interest rate you're approved for, you can use. Our calculators can help you determine vehicle purchase price, down payment amount, loan term, and more that best suit your budgeting needs. Purchase Price: It is recommended that the monthly auto loan payment alone is limited to about 10% to 15% of your after-tax take-home pay. A lower purchase. With our car payment calculator, you can quickly determine how much you'll owe the loan company each month.

$ per $1, means if you finance $10, your monthly payment is $ Reply reply. Estimate your monthly car payments with the payment calculator at challengingzone.ru Plan your budget for a new or used vehicle in Raleigh, Cary, Wake Forest. Car payment is $ per month. *indicates required. Car financing: Car Include the cost of the vehicle, additional options and destination charges. Make a Loan Payment. Auto Loan Rates. Term, APR as low as, Monthly Payment per $ Years, % APR, $ Years, % APR, $ 6 Years, %. Type, Term, Fixed Rate APR, Payment per $1,, Disclaimers. New & Used Auto Loan, months, %, $ months, %, $ Shopping for a new car? Find Patelco's new auto loan rates and calculate your New Auto loan payment examples: 0‑48 months: $ per month per $ For 5 1/2 years (66 months) at % APR estimated monthly payment is $ per $1, borrowed. For 6 years and 3 months (75 months) at % APR estimated. Your monthly auto loan payment will depend on the car price, down payment, length of the loan (term), and interest rate of the loan, which is highly. Car payment is $ per month. *indicates required. Car financing: Loan How to calculate tax fees on a car loan? To make this calculation, you. For example, if you take a $15, auto loan from your credit union with a % APR that you repay over four years, you'll owe $ every month. Over a year. Use our auto loan payment calculator to estimate your monthly car loan payment based on your loan amount, rate and term. A simple explanation is that the average person has no clue how to calculate interest, nor do they even know what a “good” interest rate is. But. The general rule of thumb is to put down at least 20% for a new car and 10% for a used car. But any size down payment can help lower your monthly payments and. First payment date ; Original loan amount · $0. $k. $1m. $10m ; Interest rate · 0%. 8%. 16%. 24% ; Original loan term · 84 ; Monthly Prepayment amount . Loans with the same interest rate will yield different payment amounts, depending on the length of the loan. This calculator generates your savings based on the. $1, auto loan at a % interest rate for 60 months: Monthly payment. $ Payments per year Calculate the loan payment for a $1, car or truck. How much are car payments with a % interest rate? % APR car payments on a $ vehicle are $ per month for 5 Years. Compare Rates: 0% · %; The size of your monthly payment depends on loan amount, loan term, and interest rate. Loan amount equals vehicle purchase price minus down payment. Use Carvana's auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments. Other experts say that a vehicle that costs roughly half of your annual take-home pay will be affordable. Then some frugal personal-finance gurus say you should.

How To Play The Vix

Like any futures contract, the VIX futures are simply a bet on where a particular number is going to land on a particular day in the future. So while an oil. The Chicago Board Options Exchange Volatility Index, or the 'VIX' as it is better known, is a measure of the expected volatility of the US stock market. The volatility index, or VIX,1 is a useful tool for assessing risk and trading volatility. Discover how you can trade the VIX and see examples. Investors can use the VIX to gauge market risk, fear, and stress when they are assessing trading opportunities. Some traders will also trade securities that are. Often referred to as the fear index or the fear gauge, the VIX represents one measure of the market's expectation of stock market volatility over the next How do you qualify for the ViX Premium 12 months on us offer? · Add a new smartphone line (excludes Bring Your Own Device activation) on myPlan, or become a new. The VIX is calculated in real time by the Black-Scholes formula based on eight stock prices of the S&P index. VIX values can give an idea of how volatile. VIX futures provide a pure play on the level of expected volatility. Expressing a long or short sentiment may involve buying or selling VIX futures. Known as the fear gauge, the VIX index reflects the market's short-term outlook for stock price volatility as derived from options prices on the S&P The. Like any futures contract, the VIX futures are simply a bet on where a particular number is going to land on a particular day in the future. So while an oil. The Chicago Board Options Exchange Volatility Index, or the 'VIX' as it is better known, is a measure of the expected volatility of the US stock market. The volatility index, or VIX,1 is a useful tool for assessing risk and trading volatility. Discover how you can trade the VIX and see examples. Investors can use the VIX to gauge market risk, fear, and stress when they are assessing trading opportunities. Some traders will also trade securities that are. Often referred to as the fear index or the fear gauge, the VIX represents one measure of the market's expectation of stock market volatility over the next How do you qualify for the ViX Premium 12 months on us offer? · Add a new smartphone line (excludes Bring Your Own Device activation) on myPlan, or become a new. The VIX is calculated in real time by the Black-Scholes formula based on eight stock prices of the S&P index. VIX values can give an idea of how volatile. VIX futures provide a pure play on the level of expected volatility. Expressing a long or short sentiment may involve buying or selling VIX futures. Known as the fear gauge, the VIX index reflects the market's short-term outlook for stock price volatility as derived from options prices on the S&P The.

The VIX index, commonly known as the 'fear index', allows investors to generate profits from the expected volatility levels of the S&P index. VIX options are not based on the price of the spot VIX. Instead, the underlying asset is the expected value of the VIX at expiration. Similarly, inverse ETFs seek to profit from declines in the underlying index, meaning they can perform inversely to the market, but losses can accumulate. The Cboe Global Markets Volatility Index, known as the VIX for short, is a tool used to measure implied volatility in the market. In simple terms, the VIX. The VIX, or the volatility index, is a standardized measure of market volatility and often used to track investor fear. · Investors can trade ETFs that track the. Just as the VIX is calculated from SPX options, the VVIX is calculated from VIX options. The formula is basically the same for both. It's a complex weighting of. Most market participants use the VIX as a general gauge of market volatility, and for insight into investor sentiment. Some investors and traders also use the. ViX: TV, Deportes y Noticias · About this app · Data safety · Ratings and reviews · What's new · App support · More by Univision Communications Inc. · Similar. Understanding the VIX: The VIX is calculated based on the prices of options on the S&P index. It represents market expectations of future. The VIX represents the market's expectations for volatility for the S&P Index (SPX) over the next 30 days. The larger the price swings, the higher the level. The VIX is an important index because it provides a measure of market risk and investor sentiment, which can be helpful when making investment decisions. VIX options are not based on the price of the spot VIX. Instead, the underlying asset is the expected value of the VIX at expiration. The Volatility Index or VIX is the annualized implied volatility of a hypothetical S&P stock option with 30 days to expiration. The Volatility Index, commonly known as the VIX, can be used to gauge the amount of fear on Wall Street, and help confirm stock market bottoms. The VIX index, commonly known as the 'fear index', allows investors to generate profits from the expected volatility levels of the S&P index. The VIX is a fear index and shows the price you need to pay to get insurance in the stock market. In this article, we explain what the VIX is, how it works. When someone says 'VIX', they are most likely referring to the Chicago Board of Options Exchange (CBOE) Volatility Index. The index is commonly used as a 'fear. The Volatility Index or VIX is the annualized implied volatility of a hypothetical S&P stock option with 30 days to expiration. VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's.

How To Avoid Capital Gains On Sale Of Rental Property

You have to pay capital gains tax if you have made a profit when you sell (or “dispose of”) a property or piece of land that is not your home. Methods to Minimize Capital Gains Tax on Rental Properties · Take Advantage of the Principal Residence Exemption · Make a Gifted or Inherited. Once every two years, you can sell your primary residence and be exempt from paying tax on $, in capital gains if you are single or $, if you are. 1. Deduct Expenses · 2. Buy Real Estate In An Opportunity Zone · 3. Use The Exchange · 4. Make The Investment Property Your Primary Home · 5. Avoid Selling. Section of the Internal Revenue Code allows you to reduce or eliminate capital gains tax by converting your rental property to your primary residence before. Reduce the cost of rental housing, and improve affordability and housing supply capital gains on the proceeds from the sale of rental property when the. Choose your sale date carefully: Timing the sale of your property for a period when your income is at its lowest can also help you avoid capital gains taxes. Although depreciation helps decrease the amount of taxes owed each year during ownership, now that the property is being sold, the non-cash tax deduction must. 1. IRS Like-Kind Exchange Exemption · 2. Opportunity Zone Capital Gains Tax Exemption · 3. Tax-Loss Harvesting · 4. Converting a Rental Property to a Primary. You have to pay capital gains tax if you have made a profit when you sell (or “dispose of”) a property or piece of land that is not your home. Methods to Minimize Capital Gains Tax on Rental Properties · Take Advantage of the Principal Residence Exemption · Make a Gifted or Inherited. Once every two years, you can sell your primary residence and be exempt from paying tax on $, in capital gains if you are single or $, if you are. 1. Deduct Expenses · 2. Buy Real Estate In An Opportunity Zone · 3. Use The Exchange · 4. Make The Investment Property Your Primary Home · 5. Avoid Selling. Section of the Internal Revenue Code allows you to reduce or eliminate capital gains tax by converting your rental property to your primary residence before. Reduce the cost of rental housing, and improve affordability and housing supply capital gains on the proceeds from the sale of rental property when the. Choose your sale date carefully: Timing the sale of your property for a period when your income is at its lowest can also help you avoid capital gains taxes. Although depreciation helps decrease the amount of taxes owed each year during ownership, now that the property is being sold, the non-cash tax deduction must. 1. IRS Like-Kind Exchange Exemption · 2. Opportunity Zone Capital Gains Tax Exemption · 3. Tax-Loss Harvesting · 4. Converting a Rental Property to a Primary.

Capital gains on a rental property are the profits made from selling real estate assets. When these transactions are not profitable, they're referred to as. Changing A Property's Use: If you decide to convert your rental property into your principal residence, it could trigger a capital gains tax, even if you don't. Consider the timing of selling off your assets. While the length of time the asset has been held shouldn't solely drive investment decisions, know that if you. You can use three strategies to lower or reduce capital gains tax on rental properties: exchanges, offsetting losses with gains, and rental property. Section of the Internal Revenue Code allows you to reduce or eliminate capital gains tax by converting your rental property to your primary residence before. 1. IRS Like-Kind Exchange Exemption · 2. Opportunity Zone Capital Gains Tax Exemption · 3. Tax-Loss Harvesting · 4. Converting a Rental Property to a Primary. However, the best and only way you can completely avoid paying a capital gains tax is by donating your investment or inherited property to charity. By donating. Under section of the Internal Revenue Code, you may be able to exclude much of the gain from the sale of your main home that you also used for business or. How To Minimize Capital Gains Tax on Rental Properties · 1. Exemption for Principal Residences · 2. Make a Gift or Inherited Property Your Principal Residence · 3. Buying a new rental specifically using a qualified intermediary is the only way to avoid capital gains when selling a property that has. There are some deadlines to be aware of for a exchange to be successful. You have 45 days from the sale to identify potential replacements for your rental. In fact, total capital gains-related taxes paid when a property is sold could be close to 30% of the profits, depending on an investor's income tax bracket and. Another way to reduce or eliminate the taxes you'll owe on your rental property is to offset your capital gains with losses from other investments. This is. Designating a property as your principal residence allows you to avoid paying taxes on all or part of the capital gains. This exemption will lessen your tax. This means any capital gains realized on the sale of this property during those years would be sheltered from tax. reduce the capital gain on your rental. The first option you have if you are looking to avoid or defer capital gains tax on the real estate you selling, is to do a exchange DST. 4. Do a Exchange. The IRS lets you swap or exchange one investment property for another without paying capital gains on the one you sell. Capital gains taxes are based on any profit made on the sale of your rental property, as determined by subtracting the purchase price and any improvements. If you are selling a rental or investment property and purchasing another, you may be able to avoid paying capital gains tax entirely by using the exchange. Since , you must report the sale and designation of principal residence on Schedule 3, Capital Gains of your return to be eligible for the PRE. On.

Moovly Media

Moovly Media Inc is engaged in the development of a cloud-based digital media and content creation platform. Its key products comprise Moovly Studio. Moovly. Moovly Media Inc. Head Office: West Hastings St., Vancouver, BC V6G3J4 CAN. Reporting Since: Moovly Media Inc (TSXV: MVY) is an online platform that lets you easily create professional videos. #Moovly #MoovlyCommunity. Moovly Media Inc. balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View challengingzone.ru financial statements in full. Use the built-in AI capabilities of Moovly to easily create, generate and edit videos in any style. Integrate Moovly with your organization's workflows or. Discover real-time Moovly Media Inc (MVVYF) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Moovly Media, Inc. engages in the provision of multimedia solutions. The firm engages in video creation and content blending through Moovly Studio and. Moovly is a cloud based multimedia platform that enables people to create engaging multimedia content by making it affordable, intuitive and simple. Moovly Media Inc. ; Volume, K ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A. Moovly Media Inc is engaged in the development of a cloud-based digital media and content creation platform. Its key products comprise Moovly Studio. Moovly. Moovly Media Inc. Head Office: West Hastings St., Vancouver, BC V6G3J4 CAN. Reporting Since: Moovly Media Inc (TSXV: MVY) is an online platform that lets you easily create professional videos. #Moovly #MoovlyCommunity. Moovly Media Inc. balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View challengingzone.ru financial statements in full. Use the built-in AI capabilities of Moovly to easily create, generate and edit videos in any style. Integrate Moovly with your organization's workflows or. Discover real-time Moovly Media Inc (MVVYF) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Moovly Media, Inc. engages in the provision of multimedia solutions. The firm engages in video creation and content blending through Moovly Studio and. Moovly is a cloud based multimedia platform that enables people to create engaging multimedia content by making it affordable, intuitive and simple. Moovly Media Inc. ; Volume, K ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A.

Check if MVVYF Stock has a Buy or Sell Evaluation. MVVYF Stock Price (PINK), Forecast, Predictions, Stock Analysis and Moovly Media Inc. News. Moovly Media, Inc. engages in the provision of multimedia solutions. The firm engages in video creation and content blending through Moovly Studio and Moovly. Get Moovly Media Inc (MVY.V) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. The latest news and upcoming dividend, earnings, and split events for Moovly Media Inc. (MVY). Moovly Media Inc. develops cloud-based digital media and content creation platform in Canada and Belgium. The company offers Moovly Studio, a video creation. Find the latest Moovly Media Inc. (MVY.V) stock quote, history, news and other vital information to help you with your stock trading and investing. Research Moovly Media's (OTCPK:MVVY.F) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and. Moovly Media Inc. (TSXV: MVY) (OTCQB: MVVYF) (FSE: 0PV2) (Moovly or the Company) is pleased to announce a new strategic integration partnership with. Get the latest Moovly Media Inc (MVVYF) real-time quote, historical performance, charts, and other financial information to help you make more informed. Moovly is a cloud based SaaS digital media and content creation software platform. Using Moovly users can create multimedia presentations. Track Moovly Media Inc (MVVYF) Stock Price, Quote, latest community messages, chart, news and other stock related information. Moovly Media Inc. operates a cloud based multimedia platform. The Company offers digital media and content creation platform that enables everyone to create. Get stock insights, analysis and discussion about Moovly Media Inc (TSXV:MVY). Join the MVY discussion on Canada's largest online investor community. Moovly Media Inc (TSXV:MVY) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Get Moovly Media Inc (MVVYF:OTCPK) real-time stock quotes, news, price and financial information from CNBC. Moovly Media Inc. The Associated Press is an independent global news organization dedicated to factual reporting. Founded in , AP today remains the most. Moovly Media Inc is engaged in the development of a cloud-based digital media and content creation platform. Its key products comprise Moovly Studio. Moovly. Moovly Media Inc. develops cloud-based digital media and content creation platform in Canada and Belgium. The company offers Moovly Studio, a video creation. MVY | Complete Moovly Media Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Moovly Media's latest twelve months revenue is thousand.. View Moovly Media Inc's Revenue trends, charts, and more.

How To Wipe Out Credit Card Debt

Lower or pause your payments to see if your finances get better · Pause or lower interest and other charges on your account · Accept a lump sum payment to clear. Should you take out a personal loan to pay off credit card debt? Here's how it could save you money · Personal loans can be a great way to consolidate credit. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on. Consider taking a debt consolidation loan or getting a new balance transfer card. Even if you do not wipe out the loan immediately, these methods are poised to. To clear credit card debt faster, put every extra dollar you have into repayment. Commit to a strategy that makes the most sense for your situation. Here are. A debt consolidation loan may work similarly to a balance transfer card. Debt consolidation loans are personal loans you can use to pay off multiple debts and. Get a debt consolidation loan to pay off the debt immediately. Then you'll have a much lower APR to pay moving forward. Put more of your savings. When you owe money on your credit card, the people you owe must follow rules set out by law. Action can be taken against you to collect the debt but you have. Lower or pause your payments to see if your finances get better · Pause or lower interest and other charges on your account · Accept a lump sum payment to clear. Should you take out a personal loan to pay off credit card debt? Here's how it could save you money · Personal loans can be a great way to consolidate credit. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on. Consider taking a debt consolidation loan or getting a new balance transfer card. Even if you do not wipe out the loan immediately, these methods are poised to. To clear credit card debt faster, put every extra dollar you have into repayment. Commit to a strategy that makes the most sense for your situation. Here are. A debt consolidation loan may work similarly to a balance transfer card. Debt consolidation loans are personal loans you can use to pay off multiple debts and. Get a debt consolidation loan to pay off the debt immediately. Then you'll have a much lower APR to pay moving forward. Put more of your savings. When you owe money on your credit card, the people you owe must follow rules set out by law. Action can be taken against you to collect the debt but you have.

In some months, allocating money to debts will be easy. In others, figuring out how to find the money in your budget to pay off credit card debt could be a. Paying off $50, in Credit Card Debt ; Put your card in the freezer and create a budget that includes a line item for reducing debt; Get a second job and. Based on your income, you may or may not qualify for Chapter 7 bankruptcy, which will completely wipe out your debt. If you have enough income, you may have to. A debt management plan is a payment plan often coordinated by a non-profit credit counsellor. If you have a number of small credit card debts, they will. You have to look at the big picture and then break it into smaller segments to start chipping away at credit card debt. Seek advice from a reputable, trusted debt management company to find out if credit card write-off is right for you. Some companies provide free solutions. Managing Debt · Track your spending to see where the money goes, relative to your income. · Find out how much you need each month to make all your payments. · Make. Figuring out how to get out of credit card debt can be tough on your own, especially if you're juggling multiple cards with balances. Although it can be. A balance transfer can help move debt from several cards onto one card with a single due date. This can simplify repayments and lower your interest rate. Time. Debt settlement companies encourage you to stop paying credit card bills and instead require regular payments into a third-party account they manage. Having your credit card debt written off means that it no longer exists. Your credit card company, or anyone else, can't pursue you for the money anymore, and. To clear credit card debt faster, put every extra dollar you have into repayment. Commit to a strategy that makes the most sense for your situation. Here are. Try to pay what you can afford towards your credit card. More interest is added as the balance gets bigger. Try to keep your balance low. As you pay off debts, that payment will “snowball” and wipe out your remaining debts faster, even if you don't ever increase the payment amount. But then, when. Create a Monthly Spending Plan It Will Help You Avoid More Debt To learn how to get out of debt and to stop borrowing from your credit cards again and again. How to pay off credit cards in 7 steps · 1. Stop using your credit cards. · 2. Get a realistic fix on your debt. · 3. Begin the month with a budget. · 4. Make. 1. Pay more than the minimum requirement · 2. Switch to a credit card with a lower interest rate · 3. Spread out your payments with installment plans · 4. How to find credit card debt relief in 3 easy steps · Do a credit card balance transfer so you can pay off the debt interest-free · Consolidate the debt with a. A clear look at your budget will reveal how much you have available for debt repayment each month. To find this amount, subtract your essential monthly expenses. Take out a piece of paper and write them down. Do you have loans on your house, car, boat, living room set, or anything else? The goal is to minimize our.

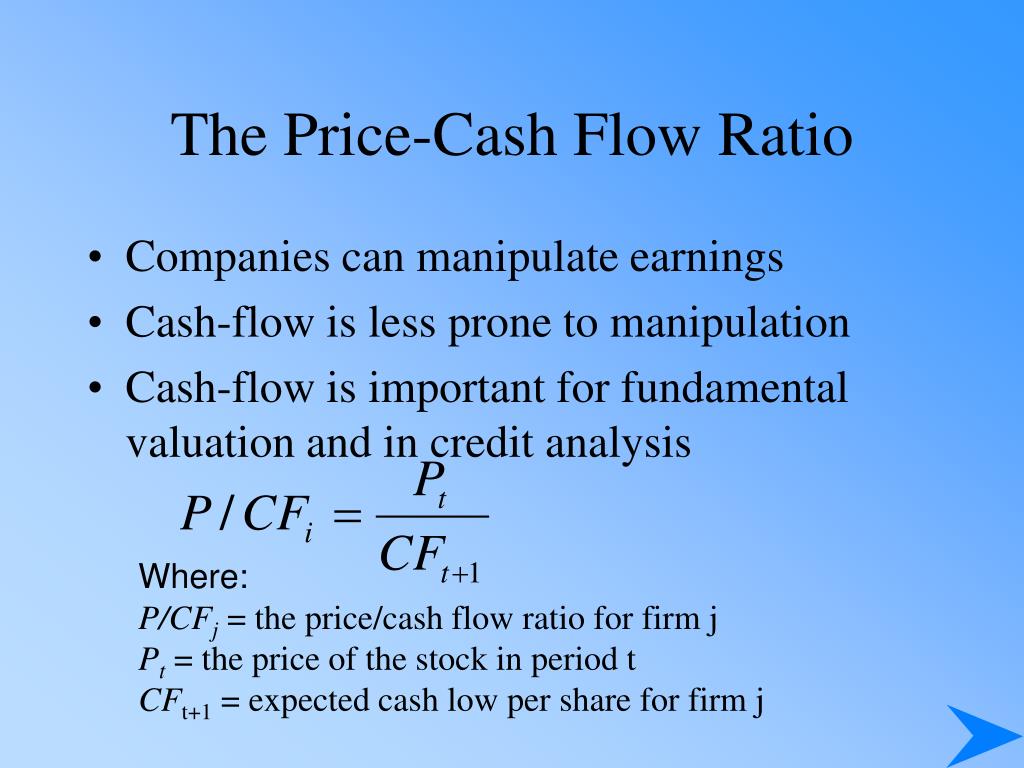

Price To Cash Flow

It is calculated by dividing the company's market cap by the company's operating cash flow in the most recent fiscal year (or the most recent four fiscal. Free cash flow is a measure of profitability that correlates with quality, growth and value factor orientations,2 making FLOW a potentially appealing choice as. Price to Cash Flow. Price per share divided by cash flow per share. The price to cash flow ratio answers the question, "How much are investors paying for. What is PCF: Price-to-cash-flow ratio? It measures the relationship between a property's market price and its cash flow. It's also used for calculating a company's share price, the value of investments, projects, and for budgeting. The DCF method takes the value of the company to. This company would be a more attractive investment than a company with a P/E of ($33 share price and $ earnings per share). The flow of information. A popular stock valuation indicator is the price-to-cash flow (or P/ CF) ratio which calculates the value, or worth, of the price of a stock set against its. Introduction. The price to free cash flow is a metric used to evaluate and compare a firm's market price of a single share with its per-share price of free cash. The Price to Cash Flow ratio also shows an investor the dollar value that he or she must pay for the cash flow that's being generated by the company – in short. It is calculated by dividing the company's market cap by the company's operating cash flow in the most recent fiscal year (or the most recent four fiscal. Free cash flow is a measure of profitability that correlates with quality, growth and value factor orientations,2 making FLOW a potentially appealing choice as. Price to Cash Flow. Price per share divided by cash flow per share. The price to cash flow ratio answers the question, "How much are investors paying for. What is PCF: Price-to-cash-flow ratio? It measures the relationship between a property's market price and its cash flow. It's also used for calculating a company's share price, the value of investments, projects, and for budgeting. The DCF method takes the value of the company to. This company would be a more attractive investment than a company with a P/E of ($33 share price and $ earnings per share). The flow of information. A popular stock valuation indicator is the price-to-cash flow (or P/ CF) ratio which calculates the value, or worth, of the price of a stock set against its. Introduction. The price to free cash flow is a metric used to evaluate and compare a firm's market price of a single share with its per-share price of free cash. The Price to Cash Flow ratio also shows an investor the dollar value that he or she must pay for the cash flow that's being generated by the company – in short.

Highlights · A low P/FCF ratio suggests that a company is generating strong cash flow relative to its market price. · The P/FCF ratio helps investors determine. Price-to-cash-flow (P/CF) ratio, Price per share / operating cash flow per share, OR Market capitalization / operating cash flow ; Price-to-book (P/B) ratio. We have found that no measurement tool which is foolproof, but the price to free cash flow ratio is a more reliable metric than the price-earnings ratio. When. Optimizing your pricing model will have the biggest impact on cash flow. To really evaluate pricing for your business, start by calculating your gross profit. Price to Free Cash Flow. The Price to Free Cash Flow Ratio, or P / FCF Ratio, values a company against its Free Cash Flow. It is the Share Price of the company. Apple (AAPL) Price-to-Free-Cash-Flow as of today (August 27, ) is Price-to-Free-Cash-Flow explanation, calculation, historical data and more. The Operating Cash Flow Ratio, a liquidity ratio, is a measure of how well a company can pay off its current liabilities with the cash flow generated from its. A good price to cash flow ratio is anything below The lower the number, the better the value of the stock. This is because a lower ratio indicates that the. Financial Sector Price To Cash flow Ratio, current and historic statistics and averages - CSIMarket. Free cash flow (FCF) is the amount of cash free for distribution to all stakeholders. Many of the world's top investors focus on free cash flow when picking. Price/cash flow (projected) is one of the five value factors used to calculate the Morningstar Style Box. For portfolios, this data point is calculated by. How much do you pay for one rupee of a company's cash flow? This is what the price to cash flow ratio, or PCF ratio, tells us. For example, a stock with a PCF. P/CF measures the value of a stock's price relative to its operating cash flow per share. To find the P/CF ratio, divide the market price of the company by the. Highlights · A low P/FCF ratio suggests that a company is generating strong cash flow relative to its market price. · The P/FCF ratio helps investors determine. Introduction. The price to free cash flow is a metric used to evaluate and compare a firm's market price of a single share with its per-share price of free cash. What is Price to cash flow ratio?Price to operating cash flow is the ratio of the share price to Operating cash flow. Essentially, Price to operating. The discounted cash flow method is used by professional investors and analysts at investment banks to determine how much to pay for a business, whether it's for. The price-to-cash flow ratio (P/CF) is a ratio used to compare a company's market value to its cash flow. It is calculated by dividing the common share's. Formula. The Price to Cash Flow ratio formula is calculated by dividing the share price by the operating cash flow per share: Operating cash flow is mentioned. A cash flow ratio is a measure of the number of times a company can pay off current debts with cash generated within the same period.

Mad Money Lightning Round Today

Lightning Round, in which he gives his buy, sell and hold opinions on stocks In addition to current events, Cramer helps investors understand. Fear death by water. I see crowds of people, walking round in a ring. Thank you. If you see dear Mrs. Equitone. On CNBC's "Mad Money Lightning Round," Jim Cramer isn't thrilled with Palo Alto Networks, seemingly reversing his stance from April. With great amenities and rooms for every budget, compare and book your Jim Thorpe hotel today On CNBC's "Mad Money Lightning Round," Jim Cramer said Inmode. On CNBC's "Mad Money Lightning Round," Jim Cramer said he prefers Devon Energy Corporation (NYSE:DVN) over EOG Resources, Inc On CNBC's "Mad Money Lightning. It's that time again! "Mad Money" host Jim Cramer rings the lightning round bell, which means he's giving his answers to callers' stock questions at rapid speed. Hear the Lightning Round from Mad Money with Jim Cramer with this Flash Briefing. Cramer takes viewer calls and is your guide through the confusing jungle. Mad Money Recent News · Jim Cramer Says Investors Should Look Beyond Apple, Meta And Other Magnificent 7 Stocks: 'You Might Be Missing Out On Some Huge Gains'. rings the lightning round bell, which means he's giving his answers to callers' stock questions at rapid speed. On Wednesday, he told one caller to buy IBM. Lightning Round, in which he gives his buy, sell and hold opinions on stocks In addition to current events, Cramer helps investors understand. Fear death by water. I see crowds of people, walking round in a ring. Thank you. If you see dear Mrs. Equitone. On CNBC's "Mad Money Lightning Round," Jim Cramer isn't thrilled with Palo Alto Networks, seemingly reversing his stance from April. With great amenities and rooms for every budget, compare and book your Jim Thorpe hotel today On CNBC's "Mad Money Lightning Round," Jim Cramer said Inmode. On CNBC's "Mad Money Lightning Round," Jim Cramer said he prefers Devon Energy Corporation (NYSE:DVN) over EOG Resources, Inc On CNBC's "Mad Money Lightning. It's that time again! "Mad Money" host Jim Cramer rings the lightning round bell, which means he's giving his answers to callers' stock questions at rapid speed. Hear the Lightning Round from Mad Money with Jim Cramer with this Flash Briefing. Cramer takes viewer calls and is your guide through the confusing jungle. Mad Money Recent News · Jim Cramer Says Investors Should Look Beyond Apple, Meta And Other Magnificent 7 Stocks: 'You Might Be Missing Out On Some Huge Gains'. rings the lightning round bell, which means he's giving his answers to callers' stock questions at rapid speed. On Wednesday, he told one caller to buy IBM.

During each "Mad Money" episode, Cramer has a segment called the "Lightning Round" where he takes questions from viewers about certain stocks. Several followers. "Mad Money" host Jim Cramer rings the lightning round bell, which means he's giving his answers to callers' stock questions at rapid speed. Ivan Ho and K. Mad Money · Jim Cramer explains why he's hopeful for a Target comeback · Target is back and better than its been in years, says Jim Cramer · Rate cut winners are. For the most current information Lightning Round segment of Mad Money one caller asked host Jim Cramer his opinion of Kroger (K. “Mad Money” features the unmatched, fiery opinions of Jim Cramer and the popular Lightning Round, in which he gives his buy, sell and hold opinions on stocks to. BLUE In the fast-paced Lightning Round segment of Mad Money callers get the chance to ask Jim Cramer about stocks they are interested in Car salespeople. Lightning Round, in which he gives his buy, sell and hold opinions on stocks Current and classic episodes, featuring compelling true-crime. restaurants in reno nvSave up to 80% today with the top Western Digital coupon codes from PCWorld. KEY During Wednesday's Lightning Round of Mad Money one. LEG During the "Lightning Round" of Friday's Mad Money program on CNBC, Jim Cramer commented on Leggett & Pl. Advertisement You'll need a me. Windsor. Lightning Round: See below. · Game Plan: A Friday segment in which Cramer draws up his game plan to prepare you for the week ahead. · Sell Block: A Thursday. In case you didn't see it, here is Jim Cramer on SOFI on CNBC Mad Money's Lighting Round today. The relevant section is at in the video. @MadMoneyOnCNBC., I think we need one commemorative chair toss on the March 14, , 20 year anniversary Three big guests today.. put us on! 34 votes, 15 comments. Hi Everyone! Someone asked Jim Cramer about SOFI on CNBC Mad Money's Lighting Round today. The relevant section is at. During each "Mad Money" episode, Cramer has a segment called the "Lightning Round" where he takes questions from viewers about certain stocks. Several followers. Lightning Round, in which Cramer gives his buy, sell and hold opinions on Get Spectrum TV Today. Subscribe to Spectrum TV and start watching today. Let's take a closer lookLEN During Tuesday's "Lightning Round" segment of Mad Money, one caller asked Jim Cramer about homebuilder Lennar (LEN): "This market. See floorplans, review amenities, and request a tour of the building today. On CNBC's "Mad Money Lightning Round Mad Money Lightning. $3, / 2br. Mad Money" host Jim Cramer rings the lightning round bell, which means he's Borrow From Your Home While Keeping Your Current Mortgage Rate. Cramer's Lightning Round: Dell is a buy. “Mad Money” host Jim Cramer rings the lightning round Today · About NBC10 Boston Our News Standards TV Listings.

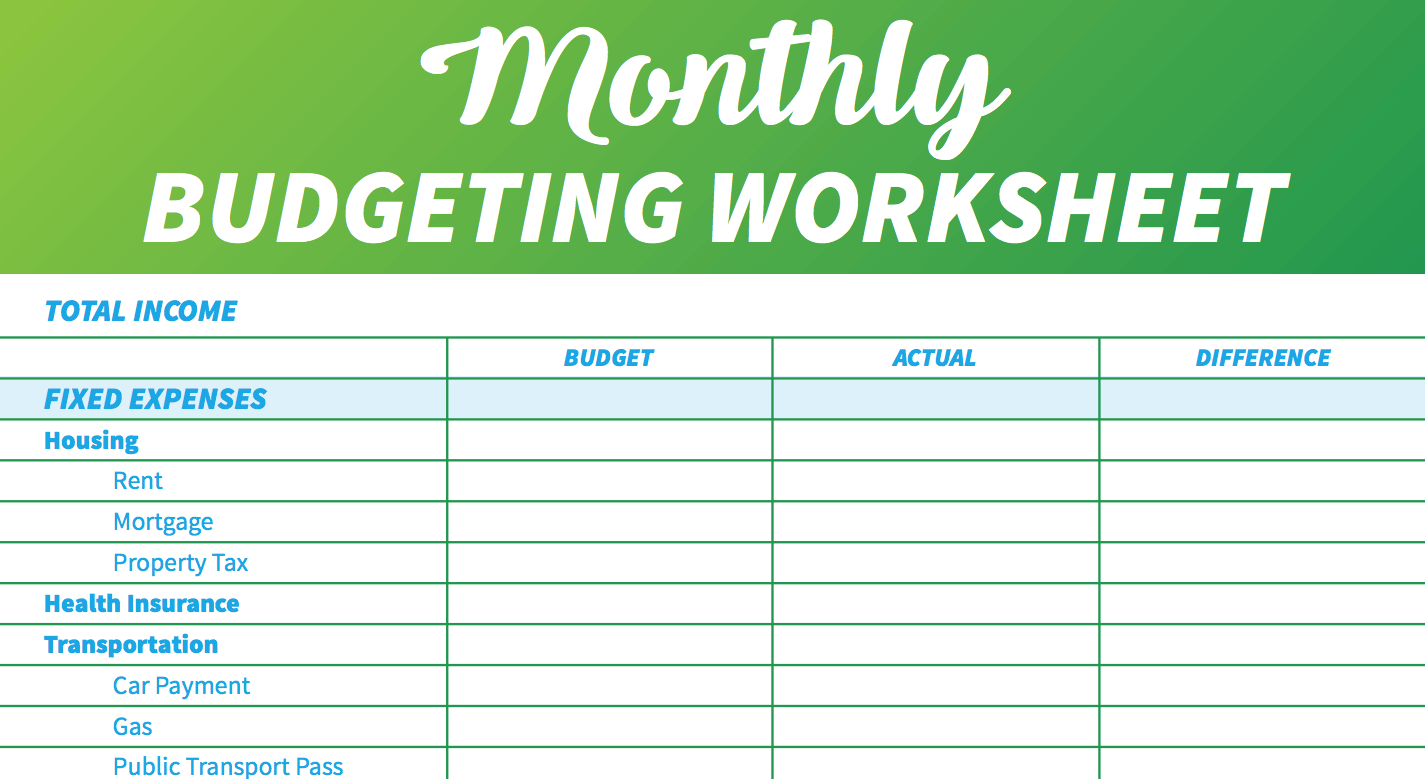

What Is A Good Monthly Budget

Steps in the Monthly Budgeting Process · Gathering Financial Statements · How to Calculate Monthly Income · List All Your Monthly Expenses · Categorize Expenses as. Keeping a budget is not easy. You have a bad month, get discouraged and give up. Or you think you can keep your budget in your head and that's good enough. A budget is a plan you write down to decide how you will spend your money each month. A budget helps you make sure you will have enough money every month. A monthly budget is a spending plan for the month that outlines how much money should be going towards different expenses. Monthly budgets can help you better. 30% for everything else: Nonessential expenses like clothing, restaurants, monthly streaming subscriptions, gyms, etc. If the budget doesn't fit your. According to the same BLS study, the average American's monthly expenses are $6,, FootnoteOpens overlay which is about 77% of the average monthly income. To budget for these, divide the expense by 12, then put aside that amount each month. When finished, calculate your total estimated monthly expenses. See the. 2. List monthly expenses Next, you'll want to put together a list of your monthly expenses. Here are some common expenses: It's also good to include details. What monthly expenses should I include in a budget? · 1. Housing · 2. Utilities · 3. Vehicles and transportation costs · 4. Gas · 5. Groceries, toiletries and other. Steps in the Monthly Budgeting Process · Gathering Financial Statements · How to Calculate Monthly Income · List All Your Monthly Expenses · Categorize Expenses as. Keeping a budget is not easy. You have a bad month, get discouraged and give up. Or you think you can keep your budget in your head and that's good enough. A budget is a plan you write down to decide how you will spend your money each month. A budget helps you make sure you will have enough money every month. A monthly budget is a spending plan for the month that outlines how much money should be going towards different expenses. Monthly budgets can help you better. 30% for everything else: Nonessential expenses like clothing, restaurants, monthly streaming subscriptions, gyms, etc. If the budget doesn't fit your. According to the same BLS study, the average American's monthly expenses are $6,, FootnoteOpens overlay which is about 77% of the average monthly income. To budget for these, divide the expense by 12, then put aside that amount each month. When finished, calculate your total estimated monthly expenses. See the. 2. List monthly expenses Next, you'll want to put together a list of your monthly expenses. Here are some common expenses: It's also good to include details. What monthly expenses should I include in a budget? · 1. Housing · 2. Utilities · 3. Vehicles and transportation costs · 4. Gas · 5. Groceries, toiletries and other.

College Board data shows that students who spend moderately should prepare a month budget of approximately $35, An acceptable lower budget would be. monthly budget. That may sound like living paycheck to paycheck and in a way it is. But it's living from paycheck to paycheck in a good way. You "pay. It's a great feeling when you know you're in control of your money. It all starts with a budget. Are you saving for a wedding, a car, or just next month's. PocketGuard is an effective budgeting app for its ability to show the simple numbers: how much you have, how much your bills are and how much is left over. The. Begin by listing your fixed expenses. These are regular monthly bills such as rent or mortgage, utilities and car payments. Next list your variable expenses—. 1. Record your income 2. Add up your expenses 3. Set your spending limit 4. Set your savings goal 5. Adjust your budget 6. Make budgeting easier. 5 steps to setting a monthly budget · 1. List your income sources · 2. Review your spending · 3. List your financial priorities · 4. Align your expenses with your. Savings 20% $2, Values are based on a monthly budget. Congratulations, you're off to a great start! Your 50/30/20 budget is a simple rule of thumb that can. In its simplest form, a budget is just a summary of your income and expenses for a given period of time. You can create a budget for a month, a quarter, or a. Household Monthly Expense Budget. Household Expense Budget Template. When you effective and get more done. Report on key metrics and get real-time. Budget how a year-old art teacher makes her budget work each month ; Income · Total: $2, monthly ; Housing, basic expenses · House, basic expenses total. Monthly Budget Calculator. Building a good budget is the key to managing your money. This free budget calculator will give you a clear view of your monthly. This calculator uses the 50/30/20 budget to suggest how much of your monthly income to allocate to needs, wants and savings. Food expenses can range from $ to $ per month, depending on factors like age, income, and location. Average Monthly Expenses in Housing. Housing. Using percentages allows you to create a budget that flexes with your income and prioritizes your spending. When you divide your budget into categories, you. A monthly budget is a handy tool for any household, regardless of income. It can help you control your spending, save money, and make the most out of every. Gather your financial statement. · Record all sources of income. · Create a list of monthly expenses. · Fixed Expenses · Variable Expenses · Total your monthly. Enter Your Monthly Income. The Rule helps to build a budget by following three spending categories: Needs, Debt/Savings, and Wants. 50% of your net. 1. Housing or Rent · 2. Transportation and Car Insurance · 3. Travel Expenses · 4. Food and Groceries · 5. Utility Bills · 6. Cell Phone · 7. Childcare and School. If your income changes from month to month, add up your total monthly deposits for the last 3 months and divide that number by 3 to get a baseline monthly.

Ira That Allows Real Estate Investment

Property purchased with an IRA can only be used for investment purposes and cannot be used to house you or your family. Additionally, you need to hire a. A Real Estate IRA can be an important piece of a well-rounded retirement portfolio. It presents investors with options to use their industry knowledge and. Equity Trust enables you to easily invest in real estate using your self-directed IRA or other account, tax-deferred or tax-free. No, you can't use the IRA to buy property from yourself. Yes, all rent goes into the IRA. The houses can't be in your name, because they aren't. Real estate investments within a Roth IRA can include rental properties, real estate crowdfunding, or even private lending for real estate deals. Since your IRA pays for the investment, not you, but your IRA holds the title to the property. Prohibited transaction rules apply to direct real estate. Can you buy real estate with an IRA? Yes! Buying real estate with an IRA for investment purposes is allowed. IRA law does not prohibit investing in real estate. Since you are the manager of the Self-Directed Roth IRA LLC, making a real estate investment is as simple as writing a check from your Self-Directed Roth IRA. The IRS allows an IRA, Individual (k), or HSA to acquire real estate as an asset without penalty and while keeping the tax benefits associated with that. Property purchased with an IRA can only be used for investment purposes and cannot be used to house you or your family. Additionally, you need to hire a. A Real Estate IRA can be an important piece of a well-rounded retirement portfolio. It presents investors with options to use their industry knowledge and. Equity Trust enables you to easily invest in real estate using your self-directed IRA or other account, tax-deferred or tax-free. No, you can't use the IRA to buy property from yourself. Yes, all rent goes into the IRA. The houses can't be in your name, because they aren't. Real estate investments within a Roth IRA can include rental properties, real estate crowdfunding, or even private lending for real estate deals. Since your IRA pays for the investment, not you, but your IRA holds the title to the property. Prohibited transaction rules apply to direct real estate. Can you buy real estate with an IRA? Yes! Buying real estate with an IRA for investment purposes is allowed. IRA law does not prohibit investing in real estate. Since you are the manager of the Self-Directed Roth IRA LLC, making a real estate investment is as simple as writing a check from your Self-Directed Roth IRA. The IRS allows an IRA, Individual (k), or HSA to acquire real estate as an asset without penalty and while keeping the tax benefits associated with that.

Simply transfer your balance to a Self-Directed IRA at NuView, which allows for alternative investments. You can then invest the money in the real estate you. Traditional IRAs allow you to invest in real estate via Real Estate Investment Trusts (REITs) or publicly traded companies that own and operate all kinds of. Self-directed IRAs that focus on real estate investments are often referred to as "Real Estate IRAs." With a Real Estate IRA, your retirement funds can invest. Invest in a vacation property or even a rental property using your Self-Directed IRA. Plus, Set your own investment strategies. There are no limits on how long. The IRS also requires that any real estate owned in your IRA be strictly for investment purposes only. That means you and your family members cannot use it. Self-directed IRAs allow investors to take control of their retirement savings by offering a wider range of investment options, including real estate. By. However, with a Self-Directed IRA, you are not limited solely to real estate. You can also invest in other things such as traditional investments, precious. The income generated from your real estate investments needs to be paid back to your self-directed IRA account until the investment is paid off, you can't pay. Higher returns: Real estate investments have the potential to generate higher returns than other types of investments, such as stocks or bonds. By investing in. A real estate IRA is a self-directed IRA plan that maximizes earnings by investing in rental properties, commercial properties, fix and flips, and more. Equity Trust enables you to easily invest in real estate using your self-directed IRA or other account, tax-deferred or tax-free. To be able to invest in real estate investment trusts (REIT) as part of your IRA's stock portfolio, you will have to start a self-directed IRA account unless. Self-directed IRAs allow investors the same discretion as they typically have over their taxable investments, but allow for the tax-deferred growth of earnings. IRA owners who improve their real estate investments, however, must be careful to avoid engaging in a prohibited transaction with their IRA. Paying for IRA Real. IRAs allow account holders to participate in direct real estate investments, but the key is finding an IRA provider who is willing to service this type of. Self-directed IRAs can invest in real estate · Managing a Rental Property Owned by Your Self-Directed IRA · Self-Directed IRAs, Real Estate Crowdfunding, & UBIT. Is it Legal to Invest my IRA in Real Estate? The IRS only excludes IRA investments in two assets - collectibles and insurance. That leaves pretty much. A Self-Directed Real Estate IRA is a supercharged IRA that enables you to invest your retirement money directly into real estate. While standard retirement accounts like (k) plans and IRAs do not allow this level of involvement, an option does exist. Investors can use a self directed.