challengingzone.ru Tools

Tools

App That You Walk And Get Money

7 Apps that Pay you to Walk · Sweatcoin · Biscuit · Better Points · Weward · Spryfit · Million Steps · Charity Miles. Did you know that you can get paid to walk? It sounds too good to be true, but you can actually earn money while keeping your body healthy and active. Sweatcoin is a new breed of step counter and activity tracker that converts your steps into a currency you can spend on gadgets, sports and fitness kit. Spot is a mobile app that provides on-demand dog walking, we have been active in many cities across North America for several years. “Basically pays you to move and exercise, and it costs nothing to use.” “The easiest way to make some side cash by doing what you already do naturally —. WALK at Home is the #1 indoor walk fitness program, designed by Leslie Sansone, to get you walking fit in the comfort of your own home. winwalk is an app that acts like a pedometer. You download it, then track your walks and runs and earn rewards that can be cashed out as gift cards. If you're. StepBet is an effective way to earn money for walking as long as you're willing to bet on yourself to achieve personal fitness goals. Stepbet is a unique app that rewards users with cash for achieving their fitness goals. Users bet on themselves to achieve their goals. If they succeed, they. 7 Apps that Pay you to Walk · Sweatcoin · Biscuit · Better Points · Weward · Spryfit · Million Steps · Charity Miles. Did you know that you can get paid to walk? It sounds too good to be true, but you can actually earn money while keeping your body healthy and active. Sweatcoin is a new breed of step counter and activity tracker that converts your steps into a currency you can spend on gadgets, sports and fitness kit. Spot is a mobile app that provides on-demand dog walking, we have been active in many cities across North America for several years. “Basically pays you to move and exercise, and it costs nothing to use.” “The easiest way to make some side cash by doing what you already do naturally —. WALK at Home is the #1 indoor walk fitness program, designed by Leslie Sansone, to get you walking fit in the comfort of your own home. winwalk is an app that acts like a pedometer. You download it, then track your walks and runs and earn rewards that can be cashed out as gift cards. If you're. StepBet is an effective way to earn money for walking as long as you're willing to bet on yourself to achieve personal fitness goals. Stepbet is a unique app that rewards users with cash for achieving their fitness goals. Users bet on themselves to achieve their goals. If they succeed, they.

Ones that I know of: Sweatcoin, Evadiation, Winwalk. All have ads, tasks, and tiny payouts.

walking with our pedometer app Play To Earn FREE MONEY. Absolutely, love it! Cool & genius level game. The reason I am giving a star is because when you get. You'll earn one heart point for each minute of moderately intense activity, such as picking up the pace when walking your dog, and double points for more. Cash for Steps' concept is simple: just download the app and walk! It's basically what you would call a “cash walking app“. Every day, the top walkers are. You can earn real money by walking with apps like Sweatcoin, Charity Miles, and HealthyWage that track your steps and reward you for being. Winwalk combines health, fitness, and rewards in one intuitive app. Join our community, hit your step goals, and enjoy the rewards of a healthier lifestyle. Ones that I know of: Sweatcoin, Evadiation, Winwalk. All have ads, tasks, and tiny payouts. Fitze - the app that rewards you for walking Earn 1 Fitze coin for every steps you take. Use these coins to unlock exclusive rewards on leading lifestyle. Charity Miles. The Charity Miles app lets you earn money for charities without begging your friends and family for walkathon donations. I love this app because it not only is fun, it helps me earn gift cards, introduce new items to try and I get my daily walking in by going through the stores. Smart Watches to help you earn rewards · Achievement: Get paid real cash to walk · Walgreen Balance Rewards: Earn dollars off by being healthy · Sweatcoin: Walk. The Charity Miles app lets you earn money for charities without begging your friends and family for walkathon donations. Achievement. Lympo. #1 – Sweatcoin Sweatcoin is probably one of the most well-known walk-and-earn apps out there. This app will reward you for sweating, and I mean that literally. Available on Android only, winwalk is another paid to walk app that gives you 1 coin for every steps you take. Similar to CashWalk, it has a limit of Fitze - the app that rewards you for walking Earn 1 Fitze coin for every steps you take. Use these coins to unlock exclusive rewards on leading lifestyle. Rewards for you and your pet. Welcome to Biscuit, your pet's wellbeing made a treat! Download the app. Track walks, earn credits per step and turn your love. Strava is beloved by thousands of runners but it's also a great app for those who prefer walking. There's both a paid and free version. Getting paid to walk may seem like a pipe dream but with these apps that pay you to walk, exercising becomes a lot more fun and more profitable. StepBet is an effective way to earn money for walking as long as you're willing to bet on yourself to achieve personal fitness goals. WinWalk is very similar to other get paid to walk apps, but it doesn't require any personal info or login to sign up — a boon for those who want a step-counting. to walk more by offering financial rewards, fostering community connections Walking will never take you as far as with this app! See more. Badcredit.

Qualifications For A Business Loan

How does Become work? · Select a loan amount and click 'Get Loan Offer' · Provide necessary information (including time in business, industry. Unsecured loan amount for start-up businesses, with less than two years in existence, is up to $25,, not to exceed (1) month gross revenue. For unsecured. It will be helpful to have copies of your most recent business and personal tax returns and/or financial statements available. Make sure you know what you need and that you are qualified before you go to the bank. In this video, we discuss credit scores and small business loan. Best for businesses that want an unsecured term loan, with a simplified application and decisioning process. SBA loan applications are structured to meet SBA requirements, so that the loan is eligible for an SBA guarantee. This guarantee represents the portion of the. You must be 18 years old or otherwise have the ability to legally contract for automotive financing in your state of residence, and either a U.S. citizen or. Small Business Loan Qualifications · Registered with the IRS as a for-profit business · Located and operating in the US as a business · Meets SBA guidelines and. Small business loan application requirements · Personal and business tax returns · Business financial statements for three past years · Current business financial. How does Become work? · Select a loan amount and click 'Get Loan Offer' · Provide necessary information (including time in business, industry. Unsecured loan amount for start-up businesses, with less than two years in existence, is up to $25,, not to exceed (1) month gross revenue. For unsecured. It will be helpful to have copies of your most recent business and personal tax returns and/or financial statements available. Make sure you know what you need and that you are qualified before you go to the bank. In this video, we discuss credit scores and small business loan. Best for businesses that want an unsecured term loan, with a simplified application and decisioning process. SBA loan applications are structured to meet SBA requirements, so that the loan is eligible for an SBA guarantee. This guarantee represents the portion of the. You must be 18 years old or otherwise have the ability to legally contract for automotive financing in your state of residence, and either a U.S. citizen or. Small Business Loan Qualifications · Registered with the IRS as a for-profit business · Located and operating in the US as a business · Meets SBA guidelines and. Small business loan application requirements · Personal and business tax returns · Business financial statements for three past years · Current business financial.

Bank Requirements for Business Loans · Credit Score · Business History · Annual Revenue · Collateral · Business Plan · Loan Approval Period. At Become we match business with lenders using AI-powered technology. Get fast offers - up to $, apply online today! Celtic Bank is a top ten national SBA lender and has helped tens of thousands of business owners get fast and affordable business loans. The interest rate for Lines of Credit approved without an SBA Guaranty meeting the auto-payment qualification will be Wall Street Journal Prime (WSJP) + %. What documents are required for a business loan? · Audited or reviewed financial statements · Copies of recent income tax returns · A year-to-date income statement. This article discusses the requirements to qualify for an SBA 7(a) loan. This includes the information buyers must provide about themselves, the opportunity. How to apply for small business loans ; Profit and loss statement and balance sheet; The most recent three years of federal income tax returns ; Business. We offer loans to small businesses who have been in operation for 2+ years and haven't declared bankruptcy in the last 7 years. Do you qualify? · Must have atleast 12 months in business · Your business must generate $50, or more in annual sales · You must own at least 20% of the business. Need funds? Learn about various business loan requirements to improve your chances. Act now for better offers. Afraid of getting rejected on your business loan application? challengingzone.ru lists 6 key requirements that will boost your odds of approval. We've put together a comprehensive guide on how to qualify for a small business loan in just 7 simple steps. Most lenders will only qualify you if you've been in business for two years, which is usually the minimum to make lenders feel comfortable about your business. How to know if you qualify for a business loan · Strong personal and business credit scores · Strong business financials · Solid business plan · Ample collateral . Bank Requirements for Business Loans · Credit Score · Business History · Annual Revenue · Collateral · Business Plan · Loan Approval Period. In order to be approved for SBA lending, at least 51 percent of the business must be owned by a U.S. Citizen (or citizens) or Green Card holder. The SBA will. Personal guarantees: SBA loans require a personal guarantee from individuals who own 20% or more of the business applying for the loan. Choosing the right. The credit score needed for a small business loan varies depending on the lender and the type of loan. However, a credit score of or higher is generally. You must own a small business or plan on buying or starting one with your funds. You must be at least 18 years old. You must have a business in an approved. Applicants must meet certain requirements to prove creditworthiness, including an established credit history and good credit score. Some financial institutions.

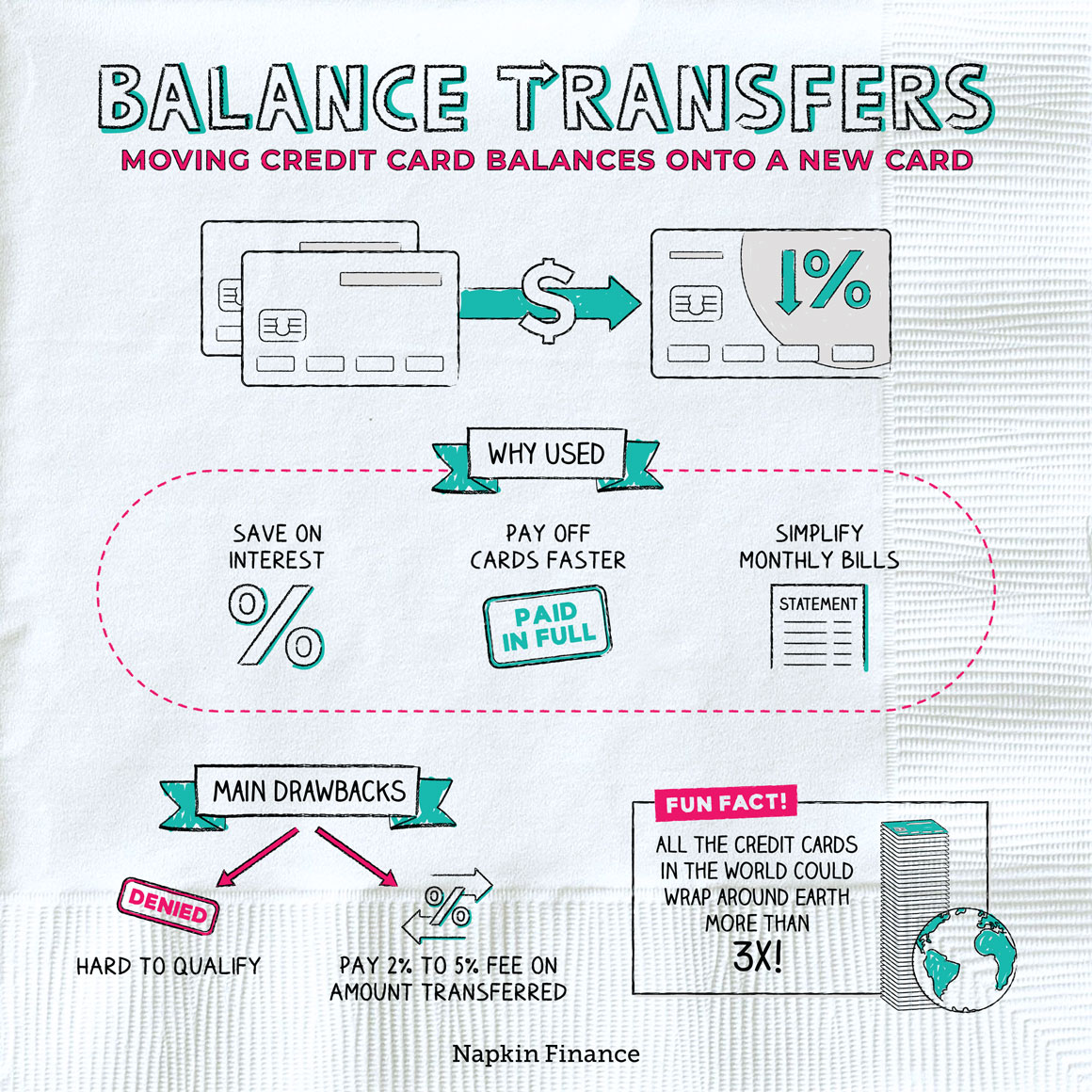

Balance Transfer Low Credit

The introductory rate may be as low as 0% and last anywhere from six to 18 months. The challenge: Transferring a balance means carrying a monthly balance, and. Balance transfers are usually done to help consolidate payments or get a lower interest rate (such as when a credit card has a low promotional rate), which. A balance transfer credit card typically offers a very low (or even 0%) APR for a limited time after signing up (usually six months to a year). One of the main reasons people choose is balance transfer credit cards is to capitalize on low or zero percent introductory APRs. This enables them to transfer. Oftentimes, credit unions and other financial institutions will offer low-interest balance transfer specials. If you are currently carrying a high balance on a. Reasons to transfer a balance · Lower your interest rate · Consolidate debt from higher-rate loans and/or credit cards · Pay off debt faster · Switch to an account. No credit score impact: balance transfers to one or more existing cards Perhaps you have several credit cards open and are carrying a large balance on one of. Balance transfer cards can help you lower your overall credit card interest and allow you pay down your credit card debt faster. I've had a rough time financially over the last year and need to move about 20k in credit card debt to a balance transfer card. The introductory rate may be as low as 0% and last anywhere from six to 18 months. The challenge: Transferring a balance means carrying a monthly balance, and. Balance transfers are usually done to help consolidate payments or get a lower interest rate (such as when a credit card has a low promotional rate), which. A balance transfer credit card typically offers a very low (or even 0%) APR for a limited time after signing up (usually six months to a year). One of the main reasons people choose is balance transfer credit cards is to capitalize on low or zero percent introductory APRs. This enables them to transfer. Oftentimes, credit unions and other financial institutions will offer low-interest balance transfer specials. If you are currently carrying a high balance on a. Reasons to transfer a balance · Lower your interest rate · Consolidate debt from higher-rate loans and/or credit cards · Pay off debt faster · Switch to an account. No credit score impact: balance transfers to one or more existing cards Perhaps you have several credit cards open and are carrying a large balance on one of. Balance transfer cards can help you lower your overall credit card interest and allow you pay down your credit card debt faster. I've had a rough time financially over the last year and need to move about 20k in credit card debt to a balance transfer card.

The best balance transfer credit cards charge no annual fee and offer 15 months or more of 0% APR for balance transfers. Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments. Balance transfer intro APR: N/A. Regular APR: See Provider Website. Annual fee: See Provider Website. Credit needed: Fair/Bad Credit. More information. A FICO. A balance transfer is a type of credit card transaction in which debt is moved from one account to another with lower interest rates. In some cases, a balance transfer could positively impact your credit scores by helping you pay off your debts faster than you would be able to otherwise. Balance transfer credit cards can help you pay down existing card balances while avoiding interest charges for an extended period. Many balance cards require a. A balance transfer credit card lets you transfer a balance from a higher-interest card to a new or existing credit card with a lower interest rate. Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. Getting a balance transfer card with a bad credit score If you have a bad or low credit score, you could still get a balance transfer card. You might be. Transferring a balance from a higher-interest credit card to a lower-interest one can be a great way to save money and get out of debt faster. Depending on the. While many balance transfer cards require good or excellent credit, there still are options for those with less than stellar credit, such as the Navy Federal. CK Editors' Tips††: Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower. A good balance transfer offer should have an intro APR that is a lower interest rate than what you pay on your current debt. Compare offers to see which has the. Many balance transfer credit cards feature a low or 0% introductory APR, allowing you to save money on interest payments. The low interest rates on balance. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. You might also lower your overall. Citi® Diamond Preferred® Card: Best feature: month 0% introductory rate on balance transfers. Citi Rewards+® Card: Best feature: Two points per dollar spent. BECU offers a low-rate and a Cash Back credit card that offers % cash back on every purchase. BECU also offers affinity card designs. Balance transfers are usually done to help consolidate payments or get a lower interest rate (such as when a credit card has a low promotional rate), which. Virgin Money Credit Builder Card - Guaranteed % APR · Virgin Money Credit Builder Card - Guaranteed % APR · Virgin Money 12 Month All Round Credit Card -. Compare Chase balance transfer credit cards – find the best option for your balance transfer needs and pay off higher-rate credit cards.